Apple introduced the Apple Card, a credit card by Apple for Apple Pay customers. This is in collaboration with Goldman Sachs and Mastercard.

Apple Card is a digital credit card within the Wallet app on the iPhone. It can be set up within minutes and used to make payments wherever Apple Pay is supported.

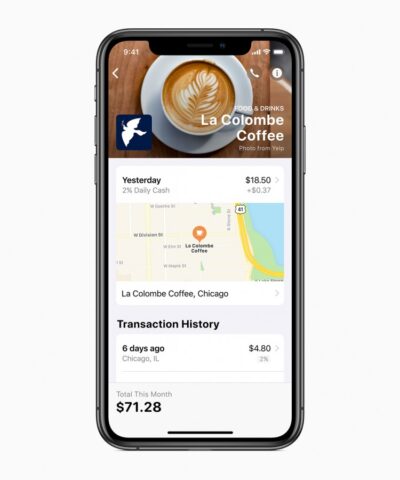

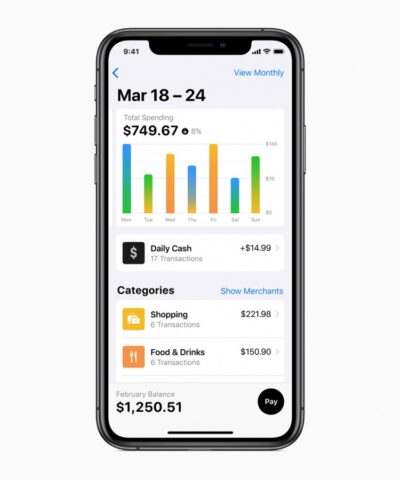

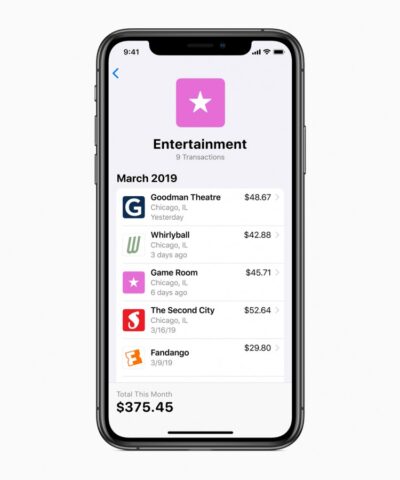

The company simplified payments history through machine learning and purchase location to figure out the merchant name and an easy-to-read format. It also classifies purchases into categories like shopping, entertainment, etc. Along with this, summaries can be viewed either in weekly or monthly form.

They’ve also set up a 24×7 support staff available through iMessage.

The card has a daily cash reward system instead of giving points. You get 2% Daily Cash added to the Apple Card each day for every purchase. For purchases with Apple like Apple Store, App Store, iTunes, etc, gives you 3% Daily Cash.

Unlike other credit cards, Apple Card has no annual fees, late, international or over-the-limit fees. An interest calculator in the app also shows how much interest you will be charged depending on how you choose to pay your bills. You will always be billed on the last day of the month and have the option of paying monthly or biweekly.

Every transaction is authorized by Touch ID or Face ID and uses a one-time unique dynamic security code for authentication.

As far as security is concerned, Apple will have no knowledge of where you shopped, what you bought, and how much you spend. They’ve also got Goldman Sachs to agree to never share or sell your data to third parties for marketing or advertising.

For places where Apple Pay isn’t supported, the company has also unveiled a physical credit card. It is machined out of titanium and will only have your name and a chip on the card, making it more secure than an average credit card. The cost for the physical card though has yet to be revealed.

Apple Card will be available to Apple Pay users in the US this summer. You can also sign up on Apple’s website to be notified when the service is available.

Ram found his love and appreciation for writing in 2015 having started in the gaming and esports sphere for GG Network. He would then transition to focus more on the world of tech which has also began his journey into learning more about this world. That said though, he still has the mentality of "as long as it works" for his personal gadgets.