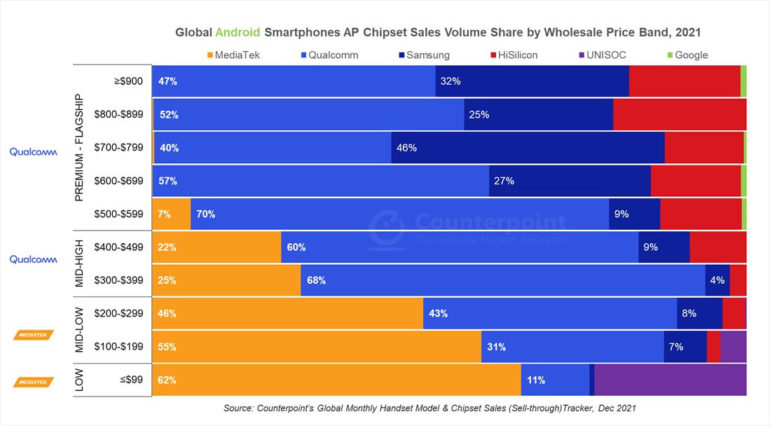

MediaTek has been dominating the Android phone SoC market since 2021 with a 45% market share. This is compared to its rival Qualcomm which had a 35% share.

A report published by Counterpoint Research shows a detailed report on the 2021 market share by price bracket. The chart above shows the leading chip manufacturers and their respective market shares during the said year.

These leading companies with the most significant market shares include Qualcomm, MediaTek, Exynos, HiSilicon, and UNISOC.

A closer look at the report shows us that the bulk of MediaTek’s share growth comes from the low to mid-tier wholesale price range (USD 299 and below), which is driven by the demand for the Dimensity 700, 800, and Helio series of SoCs.

Meanwhile, Qualcomm’s market shares (50%) are in the mid-range to premium flagship market specifically the USD 300 to USD 699 bracket. Anything from USD 700 and up is dominated by Samsung which has a 46% market share in this bracket.

The report says that the current trend is a result of the global chip shortage. Qualcomm’s gradual exit from the low-end market is a direct result of having difficulties securing chips from both TSMC and Samsung. That’s why the company focused on the production of its Snapdragon 700 and 800 chipsets instead which resulted in higher revenue and profitability.

On the other hand, phone manufacturers turned to MediaTek for their budget/low-end devices. MediaTek’s dimensity 700 to 1200 series proved to be capable and affordable 5G SoCs for this tier.

This year, with the release of the Dimensity 8000 and 9000 chipsets, it seems that MediaTek is also aiming for the majority of the high-end premium Android market.

Lastly, the report also showed markets shares of the following companies::

- Samsung’s – Exynos SoC

- low to mid-tier shares dropped from 17% to 7%

- mid to high tier dropped from 13% (2020) to 6% (2021)

- UNISOC – showed exciting growth on the USD 200 bracket (2021)

- HiSilicon – has 16% shares in the USD 500 and above bracket in 2021 but it is expected to continually drop as it depletes its inventory.

Started his freelancing adventure in 2018 and began doing freelance Audio Engineering work and then started freelance writing a few years later.

Currently he writes for Gadget Pilipinas and Grit.PH.

He is also a musician, foody, gamer, and PC enthusiast.