PayMaya was already known for being a one-stop shop for many services – transferring money, paying bills, buying load, it even had its own online mall where you can shop for essentials and so much more.

Now though, an evolution has come. With PayMaya now Maya, an all-in-one money app – it’s all you’ll ever need for your financial transactions – be it for shopping online, buying crypto, availing of credit, or even achieving your ipon goals. Not only does it let you spend, it also lets you save. With Maya Savings, you get an industry-leading 6% interest rate per annum.

We are definitely living in uncertain times, and being able to wisely save, manage, invest, and grow your money has so much more significance when we talk about the future. Here’s why we think Maya is the best app for your savings:

A Massive 6% Introductory Interest Rate

6%. Yes, you’ve read that right. Maya offers a 6% introductory Interest Rate on your savings. That’s one of the highest offered by a local bank to date, and it is available until August 31, 2022. It’s also available to all users, and you can earn the 6% interest for up to P5 million pesos in deposit. The longer you save, the more your money grows.

Lets you save for your Personal Goals

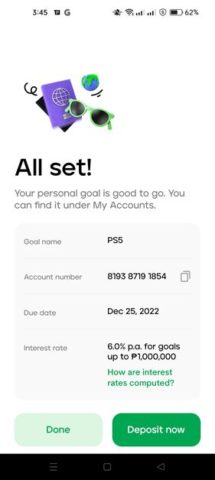

Maya just recently launched its newest feature – Personal Goals and it lets you save up for multiple purposes all at once! Whether you’re saving up for a new gadget, a side hustle, or to simply reach a savings milestone, you can do all that and keep track of your progress for each – with Maya. You can save for up to 5 goals and earn a 6% interest rate on your savings of up to P1M, per goal.

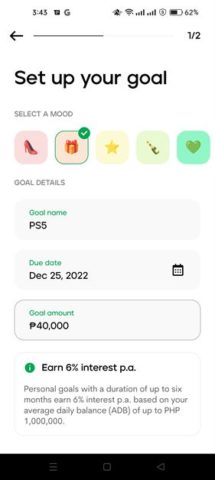

You can start a Personal Goal on your app by simply following these simple steps:

- On your Maya app, go to Savings.

- Tap personal Goals

- Select the mood that best fits your particular goal.

- Key in the goal name, due date, and goal amount. Hit continue.

- Check your goal details, then tap confirm. Key in the OTP.

- Deposit money to start your ipon goals and enjoy 6% interest rate!

Licensed by the BSP

Maya could’ve chosen to partner with a bank, but no. Maya Savings is powered by its very own Maya Bank, which is licensed by the Bangko Sentral ng Pilipinas. Moreover, it’s also PDIC-secured of up to PHP500k per depositor. That alone should give you the confidence that your hard-earned money is protected while it’s growing.

Moreover, access to the Maya app can be done through your mobile device not only with a password, but also through biometrics (fingerprint).

Opening an Account is Easy

Opening a Maya Savings account is very easy. Just make sure that you have an upgraded Maya account. If not, you can just tap the Upgrade button on the app’s home page, fill in the necessary information, submit a video selfie as well as a valid ID for verification, and in a very short time, you’ll be good to go!

Download the Maya app now from Google Play or the Apple AppStore and experience all-in-one convenience, with this all-in-one money app.

Emman has been writing technical and feature articles since 2010. Prior to this, he became one of the instructors at Asia Pacific College in 2008, and eventually landed a job as Business Analyst and Technical Writer at Integrated Open Source Solutions for almost 3 years.