EastWest Bank, in partnership with VISA launched its new and improved VISA Platinum Card, which comes with a variety of premium benefits, as well as its EastWest Pay App, which allows customers to tap-to-pay using their NFC-capable smartphones at any compatible merchant POS terminal.

EastWest VISA Platinum is accepted anywhere in the Philippines and at over 46 million establishments in over 200 countries worldwide.

- Secure and convenient payments, thanks to an EMV chip in the card, 3D secure for added authentication, and VISA PayWave support.

- Withdraw up to 70% of the credit limit from EastWest ATMs or from any ATM with the BancNet, VISA, or VISA Plus Logo.

- Pay for the Total Statement Balance or the Minimum Payment Due on the billing date.

- Pay for select items from partner establishments at 0% interest.

- Transfer other credit card’s balances to the EastWest Credit card.

- Convert their high-ticket shopping and travel expenses to installment payment terms at low interest rates.

- Convert available credit limit to cash at low interest rates and easy payment terms.

- Auto-charge bills.

- Get access to password-protected electronic statements.

What are the Benefits of Having an EastWest VISA Platinum Card?

- Newly approved EastWest VISA Platinum Cardholders who applied via the bank’s digital channels (EastWest System Tech Assistant Chatbot, EastWest Online) will get a PHP 5,000 welcome cash reward by reaching their first PHP 10,000 retail spending within two months from the date of activation.

- 8.88% Cashback Rate (monthly cap of PHP 1,250) when making purchases using their card at online and offline department stores, restaurants, fast food chains, delivery apps, airlines, lodging or hotels, travel services, vehicle rentals, fuel, and utilities, and 0.03% on other everything else.

- Access to EastWest Premium Perks for special privileges from the bank’s roster of local partners.

- Up to PHP 20 million comprehensive travel accident and inconvenience insurance when paying for international or domestic air, land, and sea travel fares using the EastWest VISA Platinum.

- A low currency conversion fee of 1.70%

- Access to a dedicated concierge, which can help cardholders with certain requests.

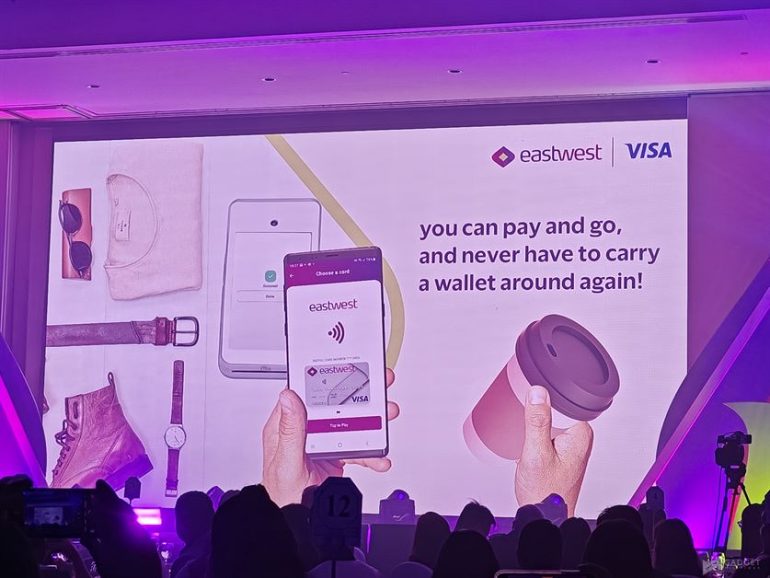

EastWest Pay App

The bank also debuted its EastWest Pay App, which lets customers connect their EastWest VISA credit cards and doing tap-to-pay at compatible merchant POS terminals using their NFC-capable smartphones. There’s no limit to the number of EastWest VISA Credit Cards that can be enrolled.

To use it, open the app, select the credit card to be used and select “tap-to-pay.” Customers can then hover their smartphone over the POS terminal to perform the transaction.

The app is currently only available for Android users and requires an internet connection for enrollment and transactions. It also lets you view your balances, monitor your spending, and temporary lock or unlock your card.

For more information, visit the EastWest VISA Platinum and EastWest Pay section on EastWest Bank’s official website.

Emman has been writing technical and feature articles since 2010. Prior to this, he became one of the instructors at Asia Pacific College in 2008, and eventually landed a job as Business Analyst and Technical Writer at Integrated Open Source Solutions for almost 3 years.