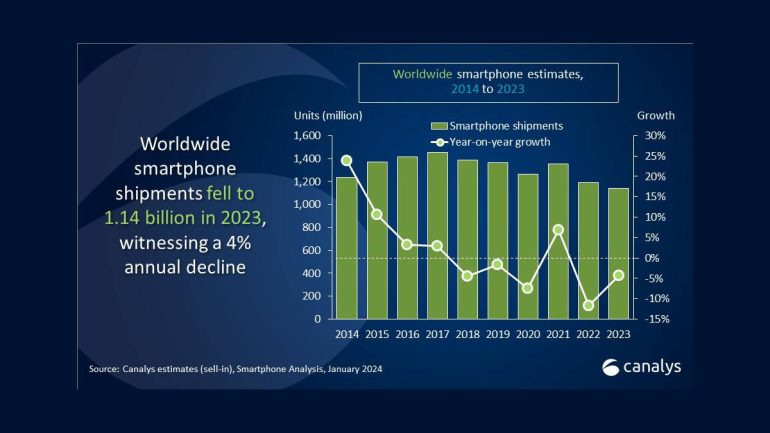

Canalys reports that smartphone shipments in 2023 were 1.142 billion, the worst in 11 years, with Apple gaining the top spot. However, the holiday period saw an 8% increase, indicating stabilization.

Canalys Global Smartphone Market Report

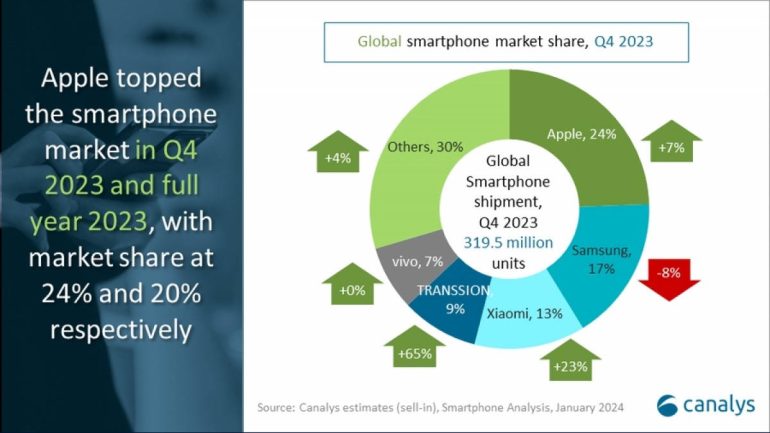

Based on the latest Canalys report, an 8% growth in Q4 2023’s global smartphone market, reaching 319.5 million units. However, it saw a 4% decline in the entire 2023 compared to 2022 amidst the stabilization of the market.

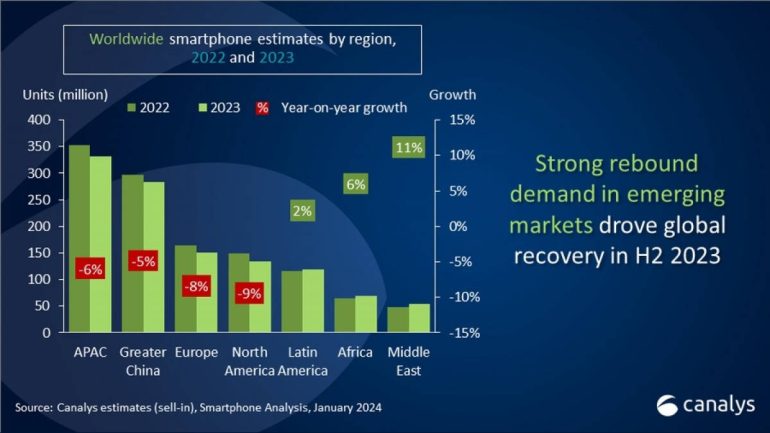

According to Sanyam Chaurasia, Senior Analyst at Canalys. The smartphone market went through many challenges, but rebounding demand in emerging markets drives global recovery in the second half of the year, with Latin America, Africa, and the Middle East experiencing year-on-year (YoY) growth.

Global Smartphone Shipments and Annual Growth

The chart below shows the market experienced a decline. Still, the backlog is no longer a major issue, and low component prices should enable vendors to implement more flexible consumer incentives.

In Q4 2023, Transsion saw the biggest increase with a 65% YoY increase. It was Apple that won big though with a 7% increase YoY which allowed it to overtake Samsung compared to the South Korean tech giant’s downward trend compared to the same period in the previous year.

| Company | Q4 ’23 shipments (million) | Q4 ’23 Market share | Q4 ’22 shipments (million) | Q4 ’22 Market share | Change |

| Apple | 78.1 | 24% | 73.2 | 25% | 7% |

| Samsung | 53.5 | 17% | 58.3 | 20% | -8% |

| Xiaomi | 41.0 | 13% | 33.2 | 11% | 23% |

| Transsion | 28.5 | 9% | 17.3 | 6% | 65% |

| vivo | 23.9 | 7% | 23.9 | 8% | 0% |

| Others | 94.4 | 30% | 90.9 | 31% | 4% |

| Total | 319.5 | 100% | 296.9 | 100% | 8% |

vivo, meanwhile, held the last spot in the top 5 list of manufacturers in the period with hardly any growth but formidable nonetheless.

The annual market share was drastically different though with Apple and Samsung almost sharing number one with a 20% market share each. Xiaomi and OPPO followed suit and Transsion took the last spot in the 2023 Top 5.

Although, it was only Transsion that saw an improvement in YoY with a whopping 27% increase. The other manufacturers all saw a dip in YoY growth even with Apple just dipping by -1%.

| Company | 2023 shipments (million) | 2023 Market share | 2022 shipments (million) | 2022 Market share | Change |

| Apple | 229.2 | 20% | 232.2 | 19% | -1% |

| Samsung | 225.4 | 20% | 257.9 | 22% | -13% |

| Xiaomi | 146.4 | 13% | 152.7 | 13% | -4% |

| Oppo | 100.7 | 9% | 113.4 | 10% | -11% |

| Transsion | 92.6 | 8% | 73.1 | 6% | 27% |

| Others | 347.9 | 30% | 364.1 | 31% | -4% |

| Total | 1142.1 | 100% | 296.9 | 100% | -4% |

Apple, Samsung, Xiaomi, and OPPO are global market leaders, with vivo and HONOR launching flagships. The two latter companies are expected to try and challenge the top brands for the top 5.

Based on what was reported, manufacturers may pursue two strategic paths in 2024: increasing shipments in the mid-to-low-end market or investing in on-device AI.

Started his freelancing adventure in 2018 and began doing freelance Audio Engineering work and then started freelance writing a few years later.

Currently he writes for Gadget Pilipinas and Grit.PH.

He is also a musician, foody, gamer, and PC enthusiast.