Investing in RTB!

There are two types of investors – those who are risk-averse and those who can take risks at the expense of possible higher return. At this time of great concern over fiscal stability, governments around the world think of ways to rise from their respective crisis and continue funding their projects for the betterment of their people.

Apart from tax collection, governments also issue retail treasury bonds or RTBs to the public. RTBs are securities that individuals and corporations can take advantage of to invest and grow their money without exposing themselves to high and ultra volatile fiscal risks. Investing in RTBs is one of the safest vehicles of investments because you’re basically lending money to the government, which guarantees (technically) the return with interest paid periodically.

And since your investments will directly go to the government, you’re essentially funding [su_pullquote align=”right”]There are two types of investors – those who are risk-averse and those who can take risks at the expense of possible higher return.[/su_pullquote]government initiatives – including those in relation to the COVID-19 pandemic. Given this, investing in RTBs is also a good way to participate in a digital bayanihan for the nation.

Last July 16, the Bureau of Treasury started offering 5YR RTB or Progreso Bonds with a coupon rate of 2.625% until August 7. Minimum investment for the 5YR RTB is PhP5,000 to a maximum of PhP50,000. This means that your investment in this RTB will give you a yield of additional 2.625% divided into quarterly payments.

You would normally be able to invest in RTBs via participating banks. Investing also requires the usual KYC processes to get investors qualified. Fortunately, interested investors do not need to physically go to the bank to invest. Thanks to Bonds.ph, powered by Philippine Digital Asset Exchange (PDAX); and their partnership with PayMaya, investing on RTBs is now easier and more accessible – even to those without a bank account. This is a convenient way to still be able to invest despite the condition we’re all in.

To start investing on RTBs, you will need to go through Bonds.ph’s know-your-customer processes and submit scanned copies, which takes about less than 5 minutes of your time. Verification process takes about 1-2 days, but you can instantly invest once your account has been verified. For easy and seamless add fund facility, PayMaya is the best option.

To start investing on RTBs, you will need to go through Bonds.ph’s know-your-customer processes and submit scanned copies, which takes about less than 5 minutes of your time. Verification process takes about 1-2 days, but you can instantly invest once your account has been verified. For easy and seamless add fund facility, PayMaya is the best option.

Adding funds using your PayMaya account is easy too. Here’s how you can do it:

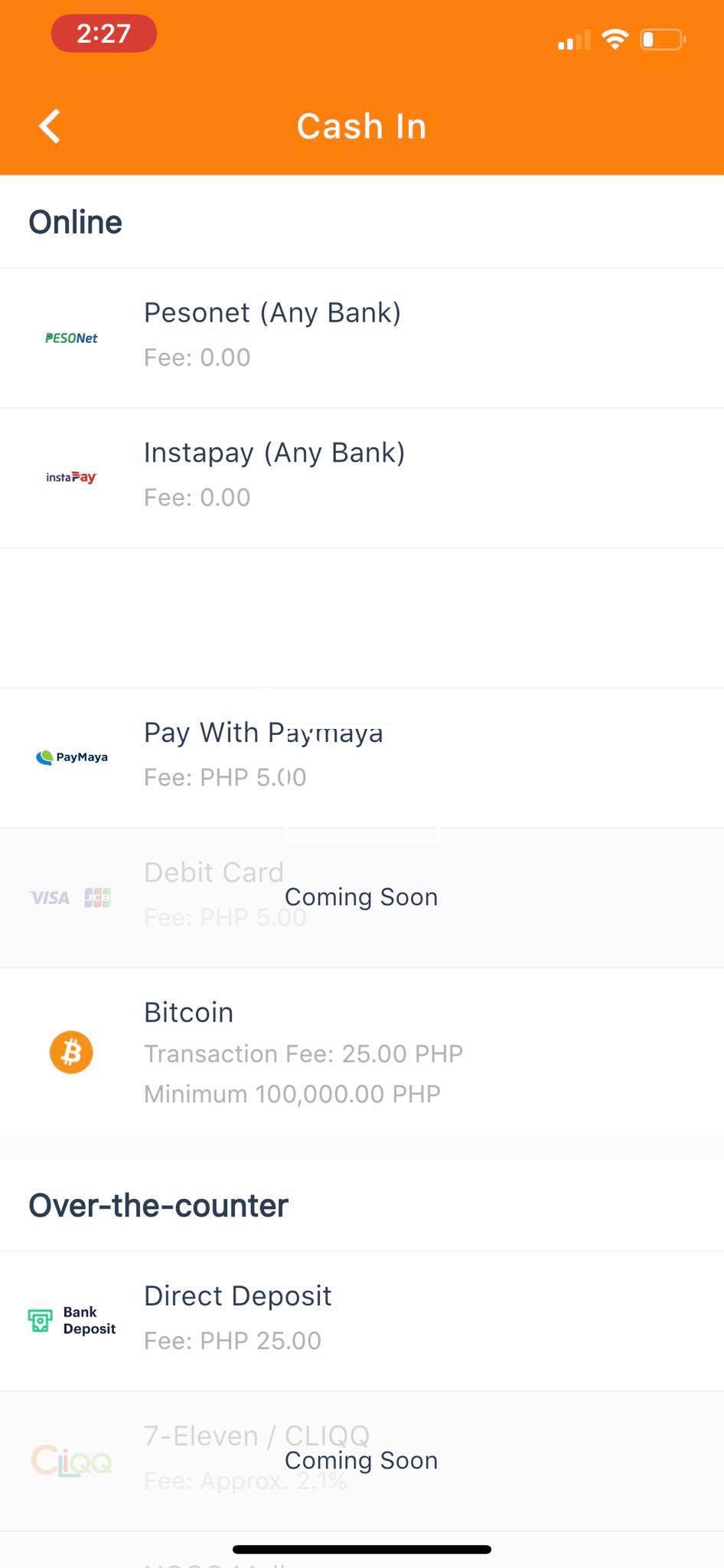

1. Go to the Cash In section of the Bonds.ph app and select Pay with PayMaya. A minimal fee of P5.00 per transaction will apply.

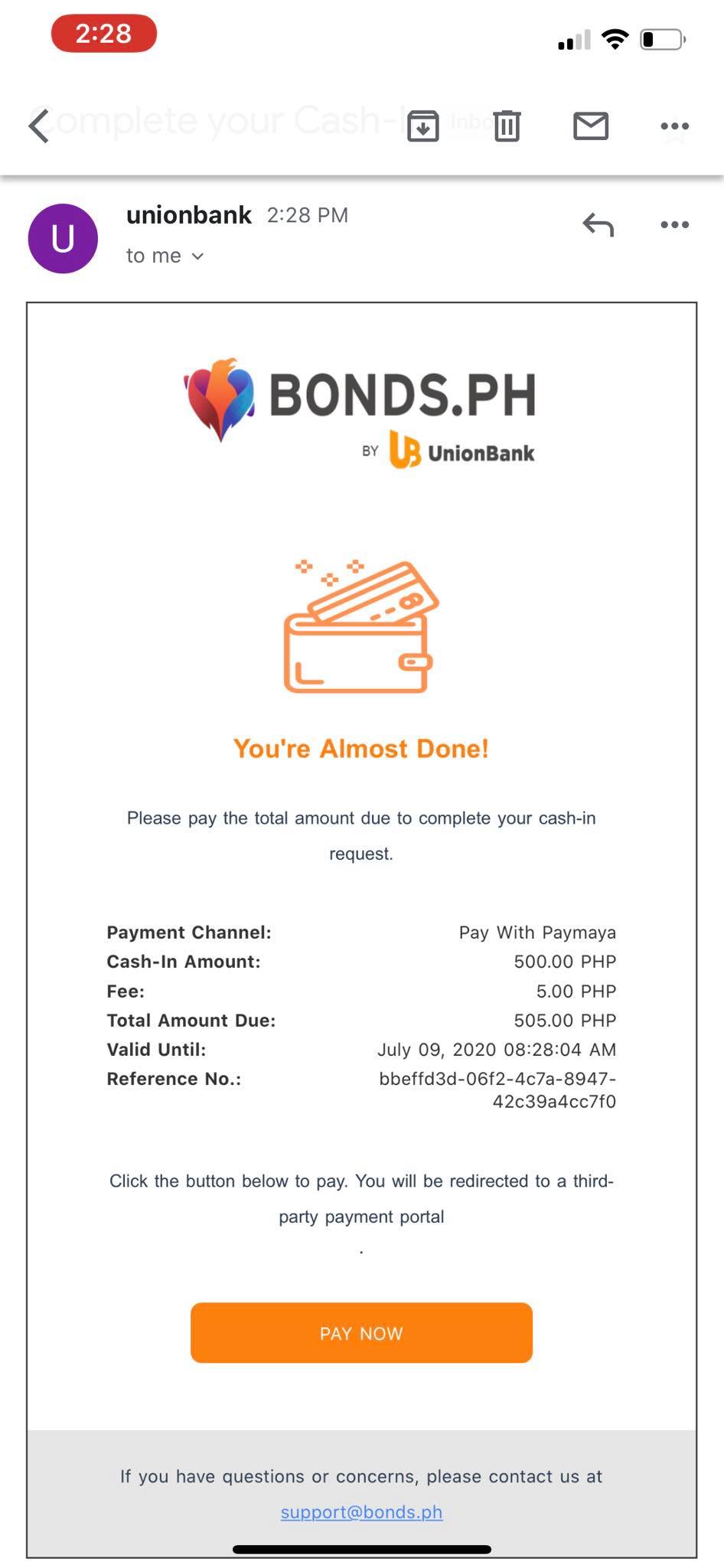

2. Choose the amount you want to cash in, then complete the payment process after receiving the payment details in your email.

2. Choose the amount you want to cash in, then complete the payment process after receiving the payment details in your email.

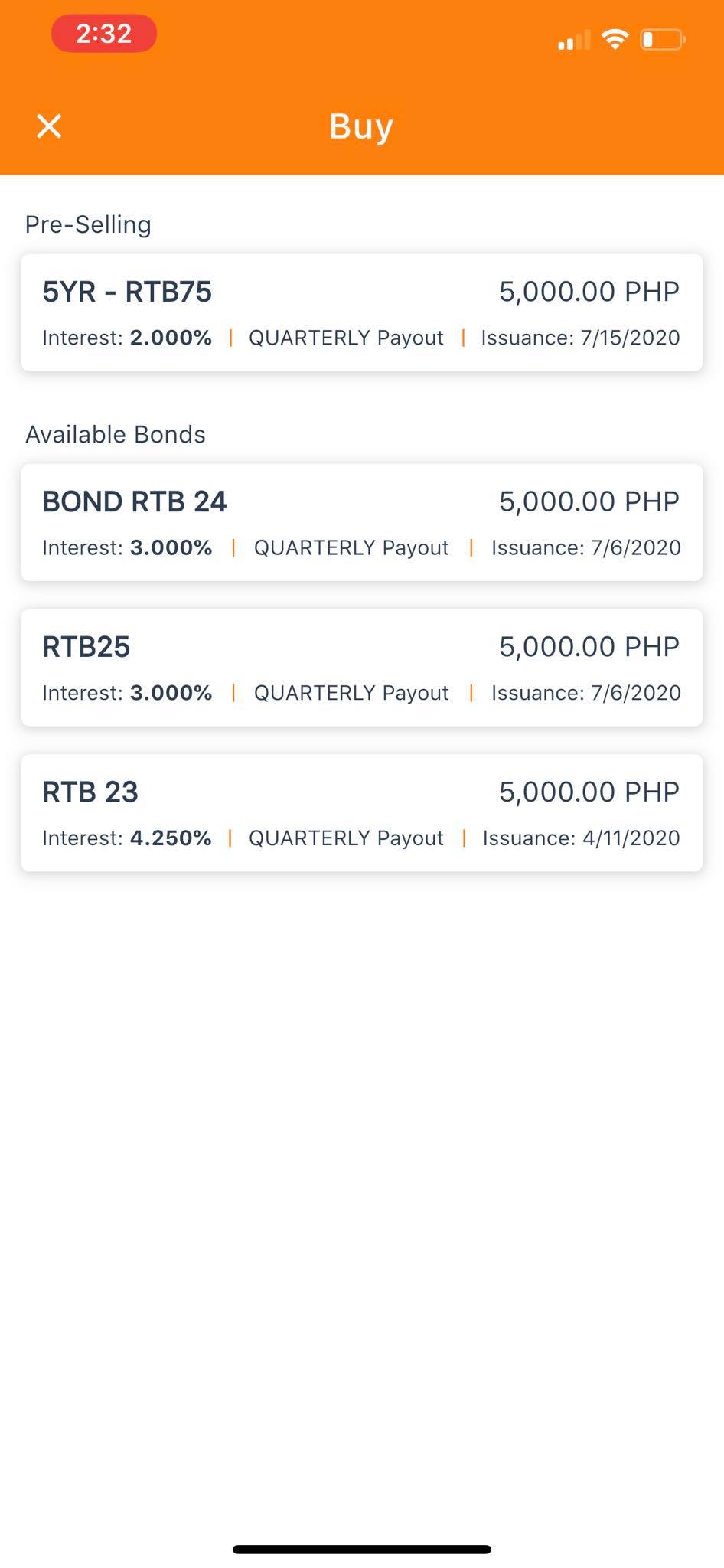

3. Once your account has been funded, choose the bond offering you want to invest in, review the transaction details, and click “Buy”

4. The subscription will have an “Awaiting Subscription” status until the final allocation is completed. All orders are considered final upon placement and can no longer be cancelled.

4. The subscription will have an “Awaiting Subscription” status until the final allocation is completed. All orders are considered final upon placement and can no longer be cancelled.

5. To check the status of your investment, click the “My Orders” button in the Bonds.Ph app. An email will also be sent to you for the notice of successful purchase of the Bond.

5. To check the status of your investment, click the “My Orders” button in the Bonds.Ph app. An email will also be sent to you for the notice of successful purchase of the Bond.

Where to download the apps?

If you’re ready try investing RTBs, here’s where you can download the apps we mentioned:

• PayMaya app download link – Link

• Bonds.ph – Google Play, iOS

A Great Start

This new payment facility by Bonds.ph will definitely encourage more Filipinos, particularly those using PayMaya, to diversify their investments in various money market vehicles. We, at Gadget Pilipinas, are excited to see more of this in the future like partnership with mutual fund and insurance companies, or perhaps directly with Philippine Stock Exchange.

Giancarlo Viterbo is a Filipino Technology Journalist, blogger and Editor of gadgetpilipinas.net, He is also a Geek, Dad and a Husband. He knows a lot about washing the dishes, doing some errands and following instructions from his boss on his day job. Follow him on twitter: @gianviterbo and @gadgetpilipinas.